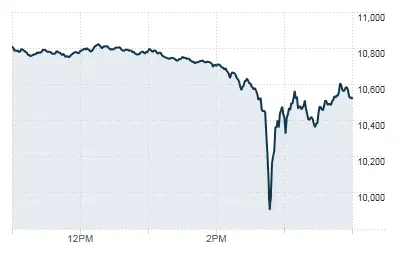

Heh. Yeah I remember that, it was wild.

I don’t think most people are aware of the physical reality of what HFTs are doing.

Relevant quote from your wikipedia:

In May 2014, a CFTC report concluded that high-frequency traders "did not cause the Flash Crash, but contributed to it by demanding immediacy ahead of other market participants

Or as the article I linked puts it:

What turns out is happening is he’s sitting physically in lower Manhattan when he makes his trades. When he pushes the “buy” button, the signal from his computer travels up the fiber optics along the west-side highway of Manhattan and through the Lincoln Tunnel. On the other side of the Lincoln Tunnel is one of the 13 stock exchanges, called the BATS Exchange founded by high-frequency traders.

They’re sitting there, and they get the signal that he wants to buy first. … They can see what he wants to do. They discern his desire to buy Microsoft, and they have faster connections to the 12 other exchanges that are scattered across New Jersey, and they race him to the other exchanges, buy all the Microsoft in front of him, and sell it back to him at a higher price.

HFT algorithms jumping on stubs seems pretty plausible to me. The whole thing is way too black box at this point, it’s ridiculous that there isn’t a clear answer.

The book Flash Boys is fantastic and goes into a lot of the HFT stuff

Yeah it’s great. Was the nail in the coffin for any weird fantasies I had about day trading. Can’t compete with that.

Honestly I think it should be required reading for anyone who is planning on investing at anything shorter than a quarterly timescale

Is there any reason not to regulate HFT out of existence ?

I understand that the stock market can be beneficial but High Frequency Trading?

It’s just a parasite to the economy, sucking money without any benefit.

Remember: Wealthy people exploiting the system are resourceful. Poor people exploiting the system are criminals.

Because wealthy people can afford lawyers and accountants to figure out how to exploit the system without breaking laws (or at least minimize the chance of going to trial, and failing that, minimize the sentence/fines.)

Its the system that’s broken, see? That’s who’s killing people now and future, not me and Elon and Jeff (AND Tim ytf does he always get a pass???) Its like, don’t hate the playa, hate the game, bro! And besides, who voted for the schmucks who set all this up anyway? I didn’t, I don’t even vote lol. No, it’s all of you! So really, it’s your fault. You’re welcome!

HFT, trading outside market hours (or markets closing, either one), dark pools, not making limit orders public… There’s plenty wrong with the stock market, some of which (and I hate to say it) is fixed by crypto…

No sir HFT provides liquidity to the stock market, which makes it more efficient.

Removing high frequency traders would cause individual traders to get worse prices and/or wider bid/ask (buy/sell) price spreads.

Basically the big players WANT you to remove HFT so they can more easily manipulate prices to take advantage of small traders

My roommate, at the time, was working as an analyst at a large bank. He claimed it was the “fat-finger theory” caused by a trader at his bank. Said some head trader meant to sell (as an example, I can’t remember the specifics he used) $100 million of a security, which is not a small trade and requires a few verification steps to proceed (entering your password multiple times). The trader hit the wrong button and the trade was made to sell $100 billion instead, which requires the same kind of multi-step verification but with these guys moving 1000 mph the million to billion swap was overlooked.

They were not real dollars and of course nobody was punished because the stock market is a casino where the house makes the rules on favor of the wealthy.

They were real dollars, and this legend got house arrest for a year for helping to trip the algos limit orders, and briefly wiped 1 trillion dollars of value off the US stock market

Sarao realised that the high frequency traders all used similar software. That made the market twitchy - like a flock of sheep, all moving in the same direction

His software took advantage of this by placing thousands of orders before quickly cancelling or changing them, once he had created artificial demand for other traders to buy or sell that asset.

This practice - known as “spoofing” - allowed him to make genuine buy or sell orders at a profit as the price swiftly rose or fell

Not even mad. Respect to this dude for striking fear into the hearts of the asshole class, if only for a few glorious minutes.

So the guy played with the system, doing things the system allows ,but because he wasn’t in the club he got punished 🤷

A tale as old as time.

He wasn’t the real cause of it though.

What do you mean? There was a liquidity crunch because of a massive mutual fund order and his spoofing tripped the algos into selling

OP’s article is quite good.

It’s more likely that there were several factors in play, including Wadell & Reed.

But if the market practices weren’t so flawed with HFTs, none of that would have caused what happened.

Yeah, as it says it’s like blaming lightning for starting a forest far.

The current dark pool stuff is probably ten times worse.

Define ‘real dollars’ lol. Most money is just numbers on a spreadsheet.

Value of stocks is what they think people will pay, but if nobody wants to buy they are worth nothing. If stocks can change in value in fractions of seconds, they have no actual monetary worth, so nothing was lost and nothing was gained during this dip and recovery.

Blah blah if you squint enough the same is true of paper money and lending, but that at least has some monetary banking while stocks are purely at a moments whim.

You see, the problem with your argument is that stock isn’t money, it’s an asset. While you can call the asset itself bogus, the money backing it is ‘real’; that’s why entire life savings can be wiped out if the market suddenly goes ‘kaput’.

So you are also saying that stocks are not real dollars. Glad we agree.

Stocks aren’t money to begin with, they’re an asset class. The money invested in stocks is as real as any other dollar though.

Money is fake

No shit Sherlock

I remember this! I was working as a waiter at a golf course at the time and there was a golf tournament going on for a financial institution. It was crazy, within seconds everything stopped and everyone was on their phones, a bunch of people left in a hurry, then in about an hour everyone was just back at it.

House arrest is not a punishment.

It was Bane as explained in the documentary film, The Dark Knight Rises

DRS GME to stop global financial fraud

deleted by creator